▷ Casier range bouteille vin en bois naturel pour cave et cellier a vin - meuble de rangement bouteille de vin au meilleur prix

![Casier Bouteille Bois Dans Porte Bouteilles, 6 Porte-Bouteilles Bois De Pin-24X24X26 Cm (Lxlxh), Nature Cave À Vin, Casier À [H343] - Cdiscount Maison Casier Bouteille Bois Dans Porte Bouteilles, 6 Porte-Bouteilles Bois De Pin-24X24X26 Cm (Lxlxh), Nature Cave À Vin, Casier À [H343] - Cdiscount Maison](https://www.cdiscount.com/pdt2/4/9/4/1/700x700/auc1696807568494/rw/casier-bouteille-bois-dans-porte-bouteilles-6-por.jpg)

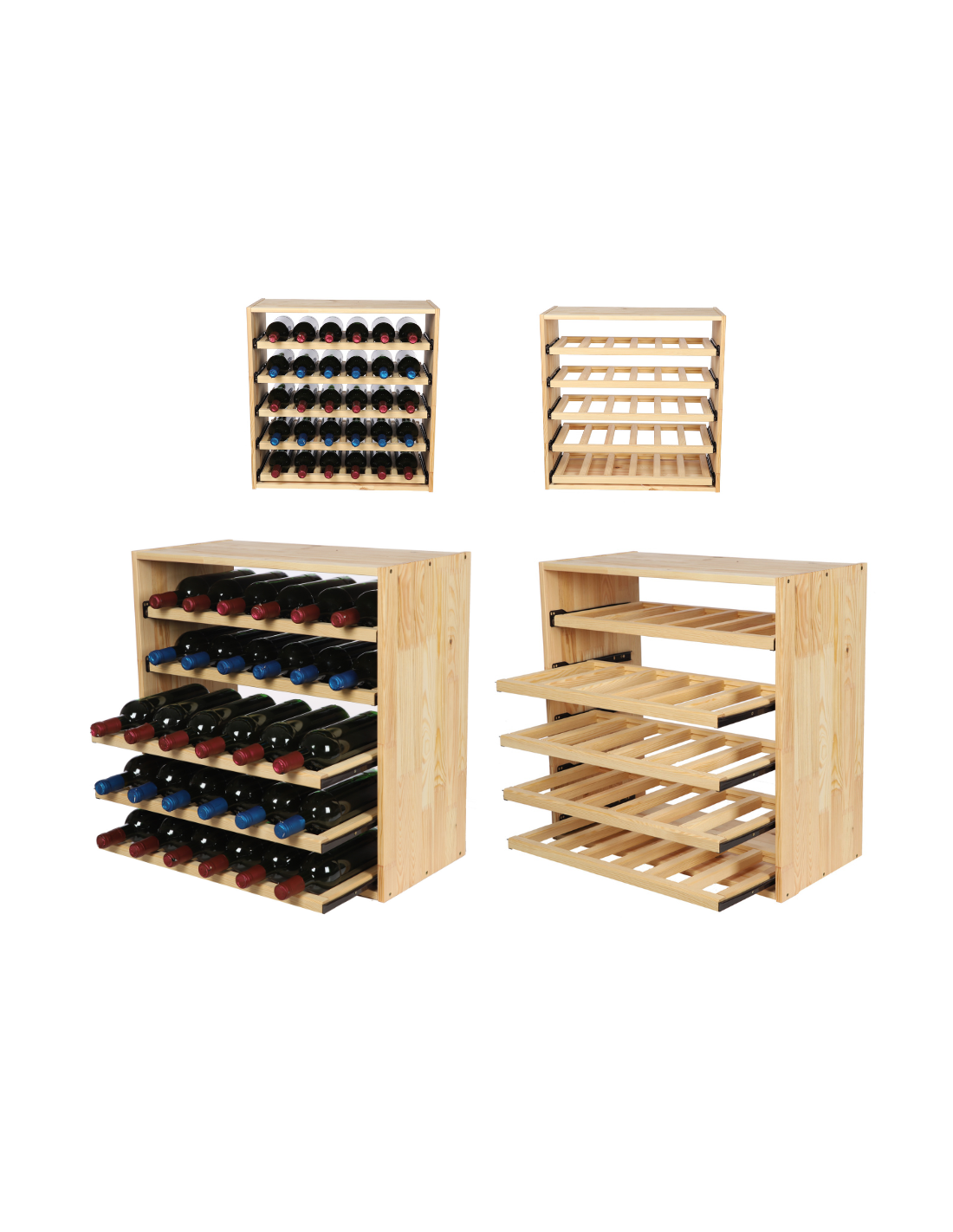

Casier Bouteille Bois Dans Porte Bouteilles, 6 Porte-Bouteilles Bois De Pin-24X24X26 Cm (Lxlxh), Nature Cave À Vin, Casier À [H343] - Cdiscount Maison

Casier à vin rustique en bois massif pour 4 bouteilles Fabriqué à la main à partir de bois véritable Design en bois vintage - Etsy France

Création de rangement bouteille de vin sur mesure pour cave à vin Paris 75000 En Île-De-France - LBG METAL ET BOIS

Relaxdays Rangement bouteilles de vin, 12 emplacements, bambou, HxLxP: 30 x 45 x 23,5 cm, non fixe, cuisine, bar, nature | Leroy Merlin

Ancien casier à bouteilles 15 cases Dubonnet | Etsy France | Casier a bouteille, Case de rangement, Casier

soges Étagère à Bouteilles Casier à vin Bouteilles en Bois Non Traité avec 12 étages pour 120 Bouteilles, 110 x 35 x 140cm : Amazon.fr: Cuisine et Maison

Casier à vin en bois pour le mur avec support en verre et lettrage VINO Marron flammé prêt à être assemblé étagère pour bouteilles de vin - France, casier à verre à

▷ Casier range bouteille vin en bois naturel pour cave et cellier a vin - meuble de rangement bouteille de vin au meilleur prix

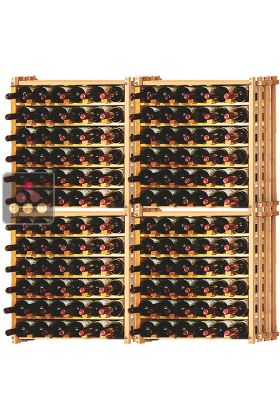

Ancien modèle : Lot de 4 casiers modulaires en hêtre massif pour 156 Bouteilles Ma Cave à Vin - Ma Cave à Vin

Casier à vin en bois pour le mur avec support en verre et lettrage VINO Marron flammé prêt à être assemblé étagère pour bouteilles de vin - France, casier à verre à